Kavout is an AI-powered market analysis platform that promises to turn real-time financial data into instant, actionable insights across stocks, ETFs, crypto, forex, and futures. I wrote this review because AI-driven research is rapidly changing how traders find opportunities and manage risk.

If you trade or manage a portfolio, understanding how Kavout processes data and delivers signals can help you save time, avoid information overload, and make more informed decisions.

I use Kavout as a daily research sidekick and for deeper dives when I’m rebalancing or hunting for new ideas. It turns noisy market data into clear signals with features like the K Score, smart screeners, and research agents that summarize news and earnings impacts.

For everyday use I check the signal feeds and watchlists; for special occasions like earnings season or portfolio reviews I lean on the automated research and portfolio tools. If you want something that reduces the busywork and surfaces ideas without needing a degree in data science, Kavout fits that role nicely.

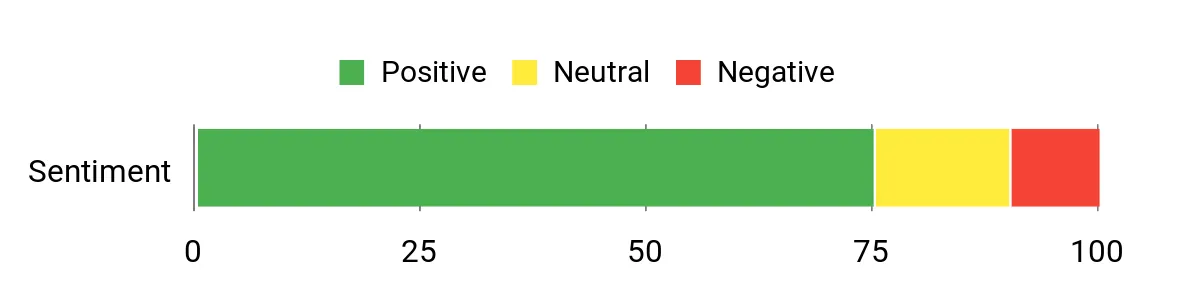

What People Say

Users often highlight how Kavout cuts through information overload. Common praise focuses on the K Score, helpful research summaries, and practical screeners that make trading prep faster and more focused.

Overall Sentiment: Positive

🗣️ SamTrader

Kavout’s K Score helped me quickly shortlist stocks before earnings season. The research agents pull news and give a concise impact summary, which saved me hours. Portfolio tools made it easy to compare risk across my holdings.

🗣️ InvestWithAmy

I rely on the signal screeners every morning. They surface unexpected opportunities across crypto and ETFs I wouldn’t have found otherwise. Alerts are timely and the dashboard stays responsive even with multiple watchlists.

|

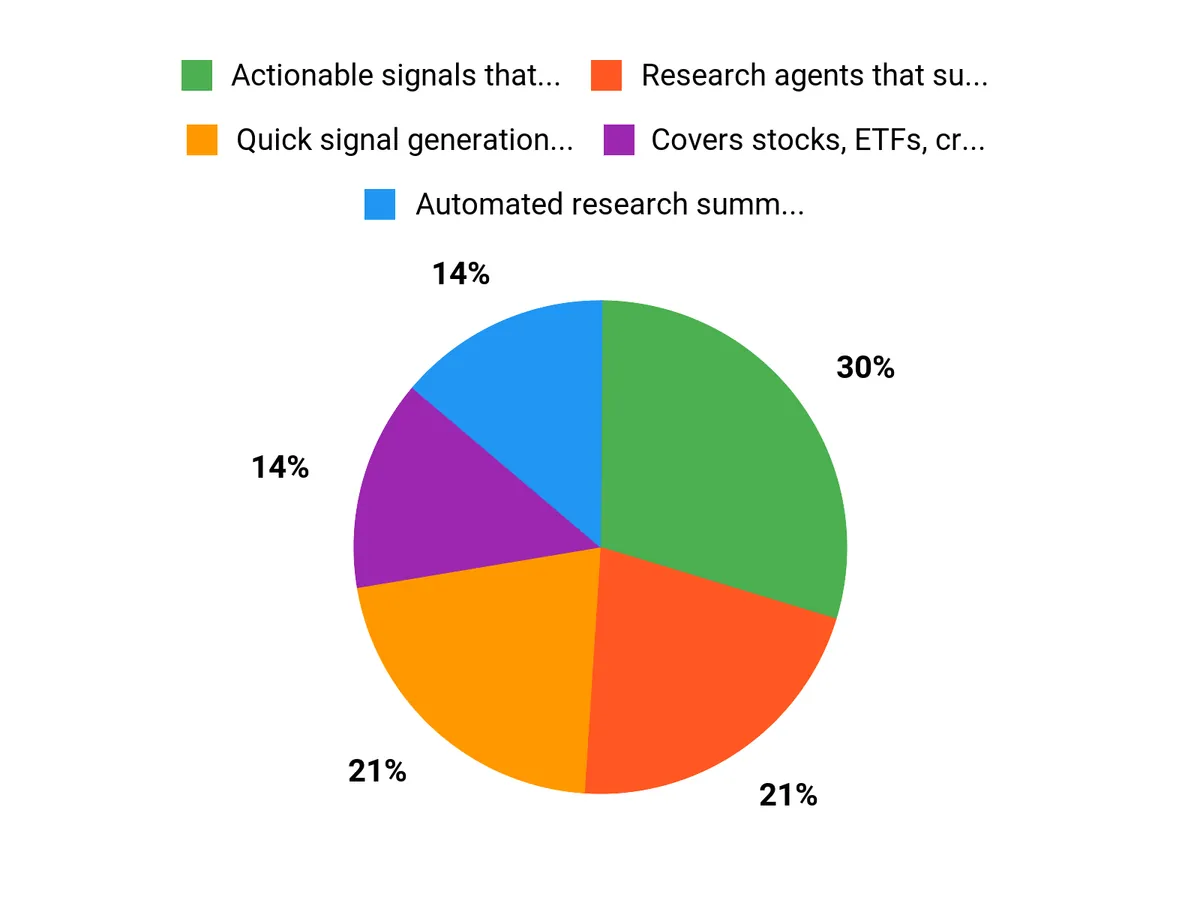

Pros |

Cons |

|---|---|

|

✅ Actionable signals that speed up idea discovery |

❌ Some features have a learning curve if you want to customize deeply |

|

✅ Research agents that summarize complex info |

❌ Advanced portfolio workflows could use more templates |

|

✅ Covers stocks, ETFs, crypto, forex, and futures |

Long-Term Cost Benefits

Over time, saving hours on research and avoiding some costly mistakes with clearer signals can offset the subscription cost—especially if you trade or manage multiple accounts.

Return on Investment

If Kavout helps you spot a few higher-probability opportunities or prevents a losing trade, the benefit can outweigh the subscription quickly. ROI depends on your trading frequency and how much time the tool saves you.

Situational Benefits

|

Situation |

How It Helps |

|---|---|

|

Daily Market Scans |

Automated signals and screeners surface actionable ideas without manual filtering. |

|

Earnings Season |

Research agents summarize news and earnings impacts so you can digest information faster. |

|

Portfolio Review |

Comparison tools highlight risk and concentration issues across holdings. |

Educational Value

Kavout helps users learn by example: seeing why a stock scores well and reviewing the research summaries teaches pattern recognition and decision criteria over time.

Ease of Use

|

Feature |

Ease Level |

|---|---|

|

Signal Dashboard |

Easy |

|

Research Agents |

Moderate |

|

Custom Screeners |

Moderate |

|

Portfolio Tools |

Easy |

Versatility

Kavout works across multiple asset classes and use cases, from quick idea generation to deeper portfolio analysis, so it fits traders with varied strategies.

Problem-Solving Ability

It addresses the common problem of information overload by prioritizing signals and summarizing research, which helps make decisions faster and with more confidence.

Performance & Speed

Dashboards and alerts are responsive; research summaries arrive quickly so I rarely wait for insights during active market hours.

Key Benefits

- Quick signal generation across multiple asset classes

- Automated research summaries that save time

- Customizable screeners and watchlists

- Portfolio comparison and risk insights

Current Price: $69.00

Rating: 5.0

FAQ

What Is Kavout And How Does It Work?

I see Kavout as an AI-powered market analysis platform that uses research agents to turn real-time financial data into instant, actionable insights across stocks, ETFs, crypto, forex, and futures. I rely on it to surface trade ideas, score opportunities, and help me optimize portfolios and automate parts of my research workflow.

The tool is designed to complement my analysis rather than replace it, and I find the AI-powered insights help me prioritize what to investigate next.

Is Kavout Worth Buying For My Trading Needs At $69?

When I consider the $69 price, I weigh the value of time saved and the quality of signals against my existing workflow. If I want faster screening across multiple asset classes, automated research, and portfolio optimization, I find Kavout to be a cost-effective option, especially given its 5.0 rating for usefulness. I keep in mind that AI is a tool, not a guarantee, so I decide to buy when I plan to actively use its insights and combine them with my own risk management and validation.

How Do I Use Kavout Daily And What Practical Tips Should I Follow?

I start my day by checking Kavout for updates on my watchlist and signals, then I use its insights to generate ideas and prioritize follow-up research. I always paper trade new strategies first, validate signals against recent price action and fundamentals, and use the platform’s portfolio tools to test position sizing and diversification.

I also set alerts for changes I care about, monitor the timestamp of data for real-time decisions, and treat the AI output as a research accelerator rather than a trading autopilot, which keeps my risk management front and center.

Why Choose Kavout

I choose Kavout because its AI-driven insights and proprietary ranking help me quickly spot high-conviction ideas while the built-in screening, backtesting, and portfolio tools let me validate and manage trades without jumping between platforms. The intuitive interface and solid support mean I can focus on strategy execution and risk control instead of wrestling with technology.

Wrapping Up

Bottom line: I find Kavout to be a capable AI research platform that turns real-time market data into practical trading ideas and portfolio insights. The research agents and cross-asset coverage make it particularly valuable for traders who monitor multiple markets.

At the current price of $69, Kavout delivers strong value for traders seeking faster, AI-enhanced decision making. If you want to automate parts of your research and get concise, actionable signals, Kavout is worth trying.

This Roundup is reader-supported. When you click through links we may earn a referral commission on qualifying purchases.